Verizon and AT&T both reported their 1Q15 results this week. On balance, the news was good, with both companies expressing a positive outlook for 2015 performance.

Capital expenditures (capex) in the quarter for both companies started at a low run-rate. Still, the numbers were expected and came in almost exactly as we had predicted. So no need for any proclamations that wireless capex is collapsing and that the sky is falling!

The really good news is that both companies reiterated their full-year 2015 capex guidance. This means that despite the slow start, we can expect network investments to ramp up progressively throughout the year.

Verizon confirmed that it would maintain 2015 capex in the $17.5-18.0 billion range, a 2-5% increase over the $17.2 billion spent in 2014. Of that total, the company will spend an estimated $10.8 billion or 61% of the 2015 total budget on its wireless network.

For 1Q15, Verizon spent $2.4 billion, down -5% compared to $2.6 billion on 1Q14 and down -11% sequentially from $2.7 billion in 4Q14. 1Q15 spending accounted for 22% of the company’s 2015 capex budget.

By comparison, AT&T previously reduced its overall 2015 capital spending guidance to the $18.0 billion range, down -15% from the $21.2 billion invested in 2014. We expect that AT&T’s 2015 wireless network investment will account for $9.9 billion or 55% of the total.

For 1Q15, AT&T’s capex was off dramatically to $1.8 billion, down -40% year-to-year (YtY) compared to $3.1 billion in 1Q14, and down -15% quarter-to-quarter (QtQ) compared to $2.2 billion in 4Q14.

During its quarterly earnings call, AT&T CFO John Stephens acknowledged the company’s low run-rate in 1Q saying “you don’t spend if you don’t need to” but emphasized that the company was not changing its full-year guidance AT&T’s 1Q15 network investment accounted for just 19% of the company’s 2015 capex budget.

In the quarter, Verizon and AT&T both realized connection growth, low post-paid subscriber churn rates, increased Smartphone penetration and growing mobile data usage. All these factors drive network densification demands for more macrocells, distributed antenna systems (DAS), small cells and Wi-Fi access points. So network investment will continue accordingly for some time.

Other national and regional carriers will be reporting their 1Q15 results in the coming weeks. However, with AT&T and Verizon together accounting for around 70% of the aggregate network investment, we are confident that their respective results are bellwethers of overall U.S. wireless capital spending for the balance of the year. That’s what we show here.

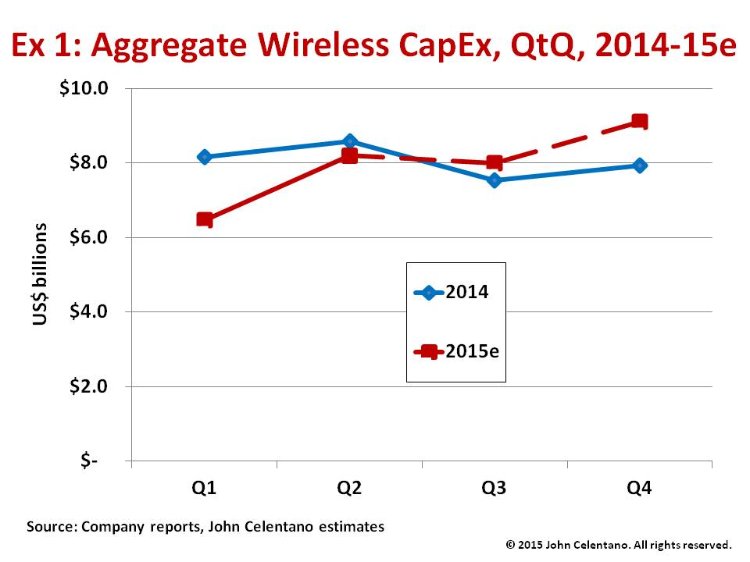

Exhibit 1 compares QtQ aggregate capex for all carriers between 2014 actual data and 2015e projections.

1Q15 aggregate spending is projected at $6.5 billion, down -19% YtY from the $8.2 billion spent in 1Q14, and down -17% QtQ from the $7.8 billion in 4Q14.

1Q15 capex represents 20% of the full-year 2015e cumulative guidance of $31.8 billion, compared to 25% of the full-year capex in 1Q14.

A year ago, 1Q14 capex represented unusually aggressive network investment, ostensibly to build network capacity ahead of demand. By contrast, 1Q15 capex levels are closer to historical spending patterns for that time of year. Certainly, persistent adverse weather across country in early 2015 contributed to delays or deferrals of planned outside construction work.

We expect 2Q15 capex to ramp up sharply to $8.2 billion accounting for 26% of the full-year guidance, then level out in a modest summer slowdown in 3Q15 to $8.0 billion or 25% of the full-year budget.

Furthermore, we anticipate a pronounced uptick to $9.1 billion in 4Q15 or 29% of the total 2015 budget as the carriers push to complete their respective densification and capacity expansion projects by year-end.

Stay tuned!