Note: This is part 3 of a series of articles analyzing the U.S. Wireless CapEx.

See Part 1: U.S. Wireless CapEx – It’s Looking Up!.

See Part 2: Big U.S. Wireless Carriers Maintain 2015 CapEx Guidance.

Part 3:

Big Picture Is Lookin’ Good

The major U.S. wireless carriers have all reported their numbers and capital expenditures (capex) for 1Q15.

Aggregate capex for the quarter tallied $7.3 billion, down -6% quarter-to-quarter (QtQ) from $7.7 billion spent in 4Q14 and down -9% year-to-year (YtY) from $8.0 billion invested in 1Q14.

Here’s the good news. Despite the slow start in 1Q15, especially after the major slowdown in 2H14, all carriers maintained their capex guidance for full-year 2015e.

1Q15 capex represented just 23% of the combined year-end guidance among all the carriers. So there is a lot more capital to be invested this year. The carriers are saying that they are “all-in!”

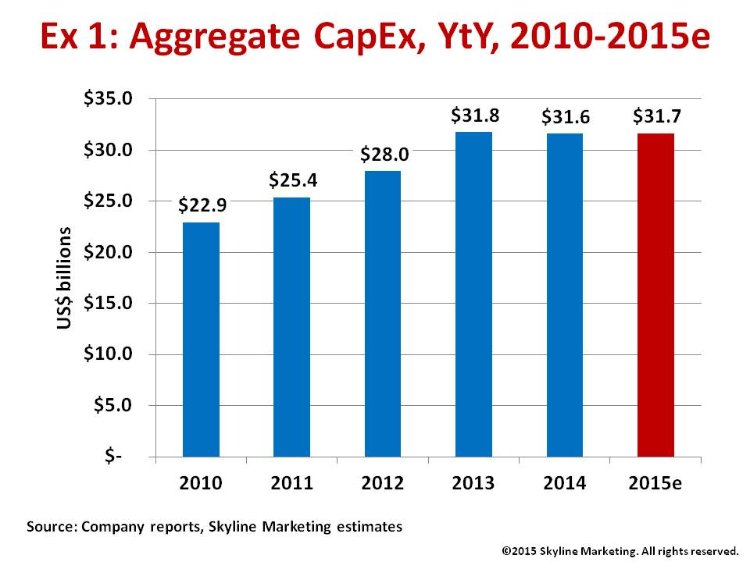

Aggregate guidance for 2015e tallies $31.7 billion, essentially flat YtY with the $31.6 billion spent in 2014, and on par with the all-time high of $31.8 billion invested in 2013. So the industry is still expanding network capacity and coverage at a high level. Exhibit 1 shows updated numbers.

Capital efficiency, that is, capex-to-service revenues is in the 16-17% range. This means that the carriers are investing in their networks at a rate to stay just ahead of surging mobile data demand.

Today, capex encompasses 3G and 4G LTE build-outs in multiple frequency bands for the macro network, deployments of distributed antennas systems (DAS) and small cells for both indoor and outdoor network densification, and cloud-based upgrades to the core switching network.

Of the total capex, about 40-42% is allocated to radio access network (RAN) deployments, another 18-22% to core switching and network management systems, and roughly 16-20% to services – everything from site planning and site acquisition to site and system engineering to program management to system installation, test and cutover. The balance is spent on backhaul equipment, site hardware and materials, and power and grounding.

Forget Quarterly Forecasts

Knowing the carrier capex for the full year is helpful benchmark for equipment manufacturers and services vendors.

Just don’t ask us how that capex will play out from quarter to quarter. There simply are too many variables that could impact network investments, either up or down, in any given quarter.

The key is to keep your eyes on the full-year prize, and not get discouraged by quarterly machinations.

That said, we think that QtQ spending in 2015e will revert to more of a historical pattern as opposed to the atypical spending that everyone suffered through the latter half of 2014.

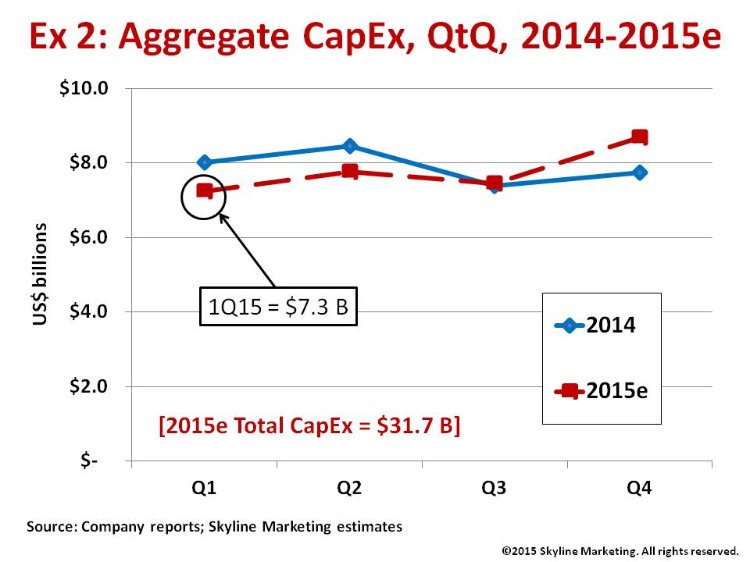

Exhibit 2 shows a projected QtQ outlook for 2015e given the 1Q15 data point compared with actual aggregate spending in each quarter throughout 2014.

We expect 2Q15 to grow close to 10% over 1Q to nearly $8 billion. A small seasonal slowdown may take place in 3Q15 with spending expect to dip slightly to about $7.6 billion. That softening likely will be followed by a spike up to $8.9 billion in 4Q15 to round out the full-year budgets.

Hey, Big Spenders!

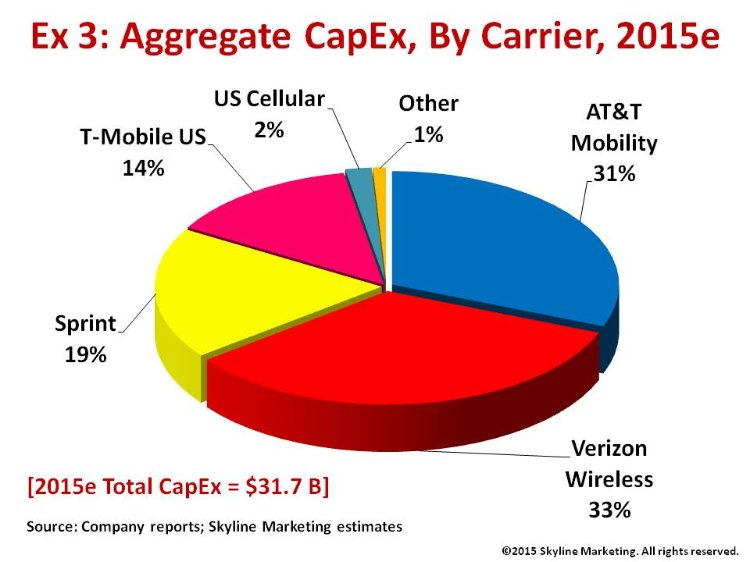

How much are the carriers investing in their respective networks? Exhibit 3 shows a breakdown of aggregate 2015e capex among the U.S. wireless carriers.

Verizon Wireless leads the pack this year with a planned investment of $10.8 billion, or roughly one-third of the overall capex. VZ’s capex is up +2% over the $10.5 billion it spent in 2014.

AT&T Mobility accounts for 31% of the total with a planned investment of around $9.9 billion. That figure is down -13% from the $11.4 billion that the company spent in 2014 as AT&T juggles capital resources to pay for the DirecTV and Nextel Mexico acquisitions, and its AWS-3 spectrum purchase.

Sprint tallies 19% of the total capex for the year. Note the company has guided to $5 billion in capex for its fiscal year 2015 that ends March 31, 2016. Our data is computed on a calendar year basis. We think that Sprint’s capex for CY2015e may come in closer to $6 billion since the company already invested nearly $2.0 billion in CY1Q15. Much of that investment is geared to building out LTE in Sprint’s 2.5 GHz spectrum. The company also has hinted that a large number of small cells could be a big part of its network build.

T-Mobile US as the fourth national carrier accounts for 14% of the total. The company has indicated it intends to invest $4.4-4.7 billion in 2015e. We take a conservative stance and adopt the low end of the guidance range for the purposes of our analysis.

US Cellular is the largest regional carrier with a projected capex budget of $600 million for 2015e, up +8% from the $558 million in 2014. The company accounts for just 2% of the total wireless capex for the year.

Dozens of smaller regional carriers led by established companies such as C Spire, SouthernLINC, nTelos, Carolina West Wireless, Bluegrass Cellular, and Cellcom to name a few. Together these carriers spend $200-300 million a year, about 1% of the total spending, modernizing their networks to serve their own subscribers and to support roaming services with the national carriers.

In the end, unrelenting user demand for anywhere, anytime high-speed wireless access will spur continued network investment. Though the timing is always hard to anticipate, the carriers must continue to upgrade their networks to meet that demand or risk losing customers.