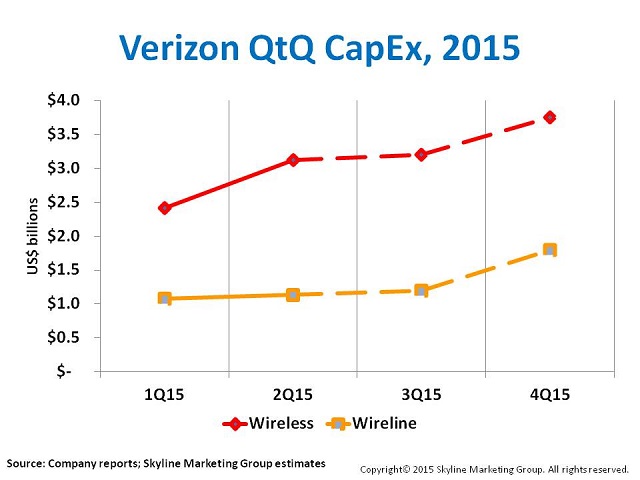

Apparently, Verizon Wireless (VZW) did not get the memo about a slowdown in capital expenditures (capex).

On July 21st, VZW reported 2Q15 capital expenditures of $3.1 billion, a jump of +29% quarter-to-quarter (QtQ) over the $2.4 billion spent in 1Q15, and up +13% year-to-year (YtY) compared to $2.8 billion in 2Q14.

In its 2Q earnings call, Verizon reiterated its guidance for total 2015 capital spending at $17.5-18.0 billion.

Through 1H15, combined wireline and wireless capex tallied $7.8 billion or 44% of guidance. Of that total, wireless capex accounted for 71% with wireline making up the 29% balance.

Assuming the wireless/wireline split holds through year-end, then Verizon’s projected 2015 investments in its wireless network are about $12.5 billion.

VZW’s 2Q15 wireless capex accounted for 25% of the full-year budget compared to 19% in 1Q15.

Wireless capex through 1H15 tallied $5.5 billion. That’s just 44% of the full-year guidance.

This means that wireless capital spending has a lot of upside and will continue to ramp through year-end.

Even with the usual summer slowdown, we expect 3Q15 capex to increase about 2% to $3.2 billion or 26% of the budget.

Watch for wireless network investments to finish with a flurry through 4Q15, spiking to $3.8 billion or 30% of the full-year budget.

Capital efficiency (CE), that is, capex-to-service revenues, was 18% in 2Q15 compared to 16% in 1Q15, even as 2Q wireless service revenues slipped -1% QtQ.

CEs of 15-20% and above indicate that the company is an expansion mode and is investing in its network ahead of anticipated demand. By contrast, CEs in the 10-15% or below range indicate that the carrier is operating in a maintenance mode.

Staying on the high-end of the CE range, VZW is charging ahead with a robust network densification program that includes macrocell additions, small cell rollouts, and in-building distributed antenna systems (DAS).

Of the total wireless capex, about 70-80% is going into the radio access network (RAN) – site development, equipment and installation, and the balance in core switching, network operations and backhaul facilities. The lion’s share of RAN investment involves new and existing macrocells. DAS deployments are still significant but are slowing.

VZW is going big on small cells and has already indicated that small cells could account for up to $500 million of its 2015 capex. Given the level of wireless network investment to date, we think that figure may be low. Small cell capex could account for about 5-6%, roughly $600-750 million, of VZW’s total 2015 wireless network investment.

Stay tuned. It’s going to be a fun run!